In today’s fast-paced world, managing finances effectively can be a daunting task. For many individuals, short-term debts accumulate quickly, leading to high interest rates that can strain monthly budgets. The good news? Refinancing these short-term debts offers a viable solution for reducing interest rates and achieving greater financial stability. This guide will explore the benefits of refinancing short-term debts, outline practical steps to take, and provide valuable insights into maximizing savings. Whether you’re struggling with credit card debt, personal loans, or payday advances, this comprehensive guide is designed to help you take control of your financial future.

Understanding Short-Term Debt

Short-term debts typically refer to financial obligations that are due within a year. Common examples include credit card balances, payday loans, and some personal loans. These debts often come with higher interest rates compared to long-term loans, making them more costly over time. By understanding the nature of these debts, you can better assess your refinancing options and make informed decisions about your financial health.

Short-term debts can quickly become overwhelming, especially when interest rates are high. Many individuals find themselves trapped in a cycle of minimum payments, barely scratching the surface of the principal amount owed. Refinancing offers a pathway to break free from this cycle by securing a loan with more favorable terms.

It’s important to recognize which debts qualify as short-term and identify the specific interest rates and terms associated with each. This knowledge forms the foundation for exploring refinancing opportunities and taking proactive steps to improve your financial situation.

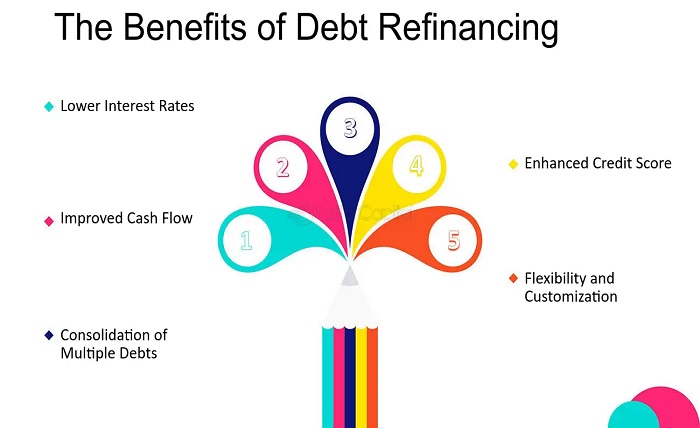

The Benefits of Refinancing

Refinancing short-term debts can provide several key benefits that contribute to long-term financial well-being. One of the most significant advantages is the potential for lower interest rates, which can substantially reduce the total cost of borrowing. When interest rates decrease, monthly payments become more manageable, freeing up cash flow for other essential expenses or savings.

Another benefit of refinancing is the potential to consolidate multiple debts into a single loan. This consolidation simplifies the repayment process, making it easier to track and manage payments. With fewer bills to juggle each month, individuals can focus on achieving financial goals without the stress of multiple due dates and varying interest rates.

Additionally, refinancing often allows borrowers to negotiate more favorable loan terms. Whether it’s extending the repayment period or adjusting the payment schedule, having the flexibility to tailor the loan to your needs can make a significant difference in your ability to maintain financial stability.

How to Refinance Effectively

Refinancing short-term debts requires careful planning and consideration. The first step is to assess your current financial situation and identify which debts are eligible for refinancing. Gather information about your outstanding balances, interest rates, and monthly payments to have a clear picture of your obligations.

Next, research potential lenders and their refinancing options. Look for reputable institutions that offer competitive interest rates and favorable terms. Comparing multiple offers can help you identify the most cost-effective solution for your needs.

When applying for refinancing, be prepared to provide documentation such as proof of income, credit history, and details about your existing debts. This information allows lenders to assess your eligibility and determine the terms of the new loan. Be sure to address any questions or concerns promptly to facilitate a smooth application process.

Choosing the Right Lender

Selecting the right lender is crucial in maximizing the benefits of refinancing your short-term debts. While traditional banks and credit unions are popular options, online lenders and financial technology companies also offer competitive refinancing solutions. Each type of lender has its own advantages and considerations, so it’s important to weigh your options carefully.

Traditional banks often provide a sense of security and reliability, especially for those with an established banking relationship. However, their application processes may be more stringent, and approval times can be longer. On the other hand, online lenders typically offer faster approval and more flexible terms, making them a convenient choice for many borrowers.

Regardless of the lender you choose, ensure that you fully understand the terms of the refinancing agreement. Pay close attention to interest rates, fees, and any potential penalties for early repayment. This knowledge empowers you to make an informed decision that aligns with your financial goals.

The Role of Credit Scores

Credit scores play a significant role in the refinancing process. Lenders use credit scores to assess the risk associated with lending money, and a higher score often results in more favorable loan terms. Therefore, improving your credit score can enhance your chances of securing a lower interest rate when refinancing short-term debts.

If your credit score needs improvement, consider taking steps to boost it before applying for refinancing. Paying bills on time, reducing outstanding debt, and avoiding new credit inquiries can positively impact your creditworthiness. While building a strong credit score takes time, the effort can pay off in the form of better refinancing options.

For those with less-than-perfect credit, some lenders offer refinancing options specifically designed for individuals in similar situations. While the interest rates may be slightly higher, these options provide an opportunity to improve your financial outlook and work towards better credit over time.

How Refinancing Impacts Your Finances

Refinancing short-term debts can have a positive impact on your overall financial picture. By lowering interest rates and streamlining payments, you gain more control over your budget and reduce the burden of high-interest debt. This newfound financial flexibility can pave the way for increased savings, investments, and financial security.

It’s important to approach refinancing with a clear understanding of your long-term goals. While refinancing can provide immediate relief, it’s essential to use the opportunity wisely and avoid accumulating new debt. Consider implementing a budget or financial plan to ensure that you’re making progress toward your objectives.

Additionally, be mindful of any fees or costs associated with refinancing. While these expenses are often outweighed by the potential savings, they should be factored into your decision-making process to ensure that refinancing remains a financially beneficial option.

Avoiding Common Pitfalls

Refinancing short-term debts requires careful consideration, and there are potential pitfalls to avoid along the way. One common mistake is failing to thoroughly research and compare refinancing offers. It’s essential to shop around and obtain multiple quotes to ensure that you’re receiving competitive rates and favorable terms.

Another pitfall is neglecting to read the fine print of the refinancing agreement. Hidden fees or unfavorable clauses can negate the benefits of refinancing and lead to unexpected costs. Take the time to review the terms carefully and ask questions if anything is unclear.

Lastly, it’s important to resist the temptation to accumulate new debt after refinancing. While the process can provide relief, maintaining disciplined financial habits is key to achieving long-term success. Avoid unnecessary spending and focus on using your newfound financial flexibility to build a secure future.

Exploring Alternatives to Refinancing

While refinancing short-term debts can be an effective strategy, it’s not the only option available. Depending on your financial situation and goals, alternative approaches may also be worth considering. For example, debt consolidation loans or balance transfer credit cards can offer similar benefits in terms of simplifying payments and reducing interest rates.

In some cases, negotiating directly with creditors may lead to more favorable terms or interest rate reductions. This option requires open communication and a willingness to explore mutually beneficial solutions. Additionally, seeking the guidance of a financial advisor can provide valuable insights and help you develop a tailored plan that aligns with your unique circumstances.

Whichever approach you choose, it’s important to take proactive steps toward managing your short-term debts and achieving financial freedom. By staying informed and exploring all available options, you can find the solution that’s best suited to your needs.

The Connection to SBA Loans

In certain situations, small business owners may find that refinancing short-term debts through a Small Business Administration (SBA) loan in Lehi is a viable solution. SBA loans often come with lower interest rates and longer repayment terms, making them an attractive option for business owners looking to improve cash flow and reduce financial burdens.

The process of securing an SBA loan involves meeting specific eligibility criteria, including demonstrating a strong credit history and a viable business plan. However, for those who qualify, an SBA loan can provide the necessary funds to refinance existing debts and strengthen the financial foundation of a small business.

It’s essential to understand the terms and conditions of an SBA loan when in Lehi and evaluate whether it’s the right fit for your business. Consulting with a financial advisor or SBA representative can offer valuable guidance and help you make an informed decision.

Conclusion

Refinancing short-term debts is a powerful tool for reducing interest rates and achieving greater financial stability. By understanding the benefits and exploring the available options, individuals can take control of their financial future and work towards long-term success.

Whether you’re a homeowner, a small business owner, or simply looking to improve your financial outlook, the strategies outlined in this guide offer valuable insights and practical steps to achieve your goals. Remember, the key to successful refinancing lies in careful planning, informed decision-making, and a commitment to maintaining sound financial habits.

If you’re ready to take action and explore refinancing options, consider reaching out to financial institutions, lenders, or advisors who can provide personalized guidance and support. With the right approach, you can transform your financial situation and pave the way for a brighter, more secure future.